You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla - Brand Perception/Opinions

- Thread starter mikeavelli

- Start date

- Status

- Not open for further replies.

CRSKTN

Expert

- Messages

- 2,421

- Reactions

- 4,051

Hopefully his flying car has better fitment then mkbhd cybertruck, cause you know results matter in aviation.

Color me shocked. Someone who has dedicated themselves to being the human equivalent of chicken mcnuggets thinks it looks "sick", unthinkable. And yet somehow even he calls out the build quality.

That is embarassing.

EDIT:

Holy sh*

On a random note in case the people who work on these cars / are generally responsible for their existance wants to learn a bit about Japanese culture

Seppuku - Wikipedia

Last edited:

mikeavelli

Moderator

- Messages

- 7,512

- Reactions

- 16,686

Tragic Bronson

Expert

- Messages

- 3,172

- Reactions

- 3,786

Where there is smoke...Dogs bark, but the caravan moves on. It is hilarious how Telsa haters and Tesla fanboys have become equally pathetic in their derangement.

Tragic Bronson

Expert

- Messages

- 3,172

- Reactions

- 3,786

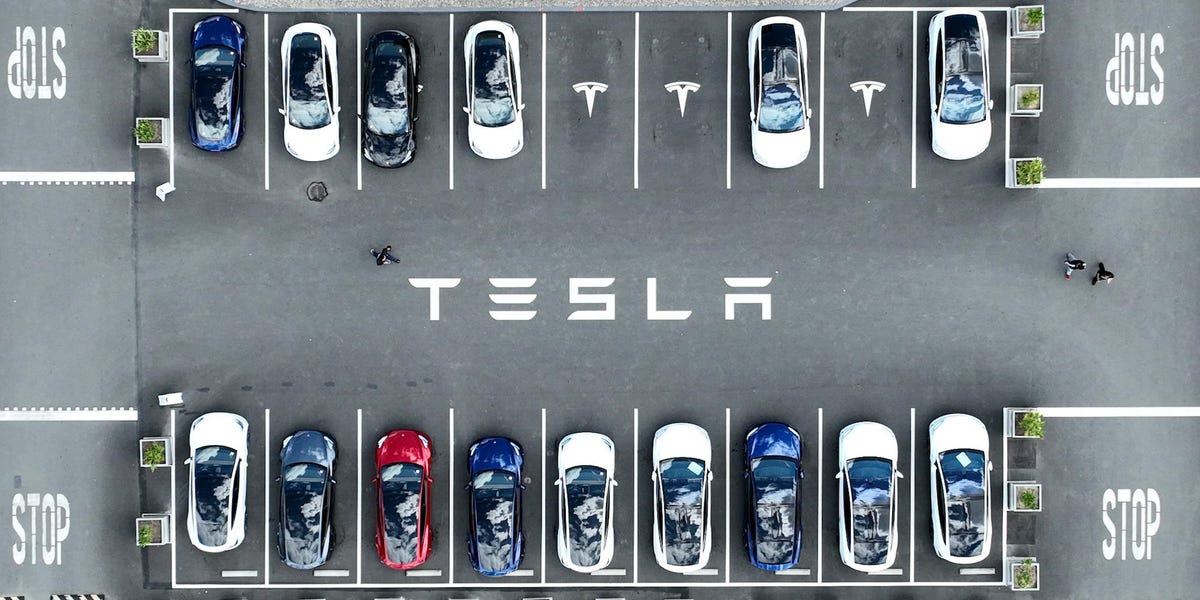

Tesla is so desperate for sales it's started advertising, something Elon Musk famously said he 'hates'

Tesla is having a bad year so far, so the company has turned to advertising to boost its sales — something its CEO Elon Musk has said he "hates."

Would-be Tesla buyers snub company as Elon Musk's reputation dips - Autoblog

The ranks of would-be Tesla buyers in the United States are shrinking, according to a survey by market intelligence firm Caliber, which attributed the drop in part to CEO Elon Musk's polarizing persona.

They are making every delivery include a fsd demo.

Tesla is so desperate for sales it's started advertising, something Elon Musk famously said he 'hates'

Tesla is having a bad year so far, so the company has turned to advertising to boost its sales — something its CEO Elon Musk has said he "hates."www.businessinsider.com

Would-be Tesla buyers snub company as Elon Musk's reputation dips - Autoblog

The ranks of would-be Tesla buyers in the United States are shrinking, according to a survey by market intelligence firm Caliber, which attributed the drop in part to CEO Elon Musk's polarizing persona.www.autoblog.com

Last edited:

Its hard to place the Teslas Q1 sales. By the numbers they missed big. However compared to the other guys EVs only, Lexus included, they still are doing great.

In other news

Stock price took a hit (tbf it goes down even when they outsell estimates), and now select vehicles are getting price bumps (i guess logic be damned)

In other news

Stock price took a hit (tbf it goes down even when they outsell estimates), and now select vehicles are getting price bumps (i guess logic be damned)

Last edited:

Tragic Bronson

Expert

- Messages

- 3,172

- Reactions

- 3,786

Tesla Sales Fall 8.5% In First Quarterly Drop Since 2020, Retakes EV Leader Crown | Carscoops

Despite the drop, Tesla outsold BYD's 300,114 Q1 deliveries, regaining the top spot in electric vehicle sales

Tesla Sales Fall 8.5% In First Quarterly Drop Since 2020, Retakes EV Leader Crown

Despite the drop, Tesla outsold BYD's 300,114 Q1 deliveries, regaining the top spot in electric vehicle sales

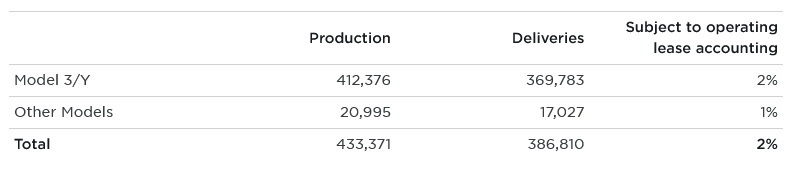

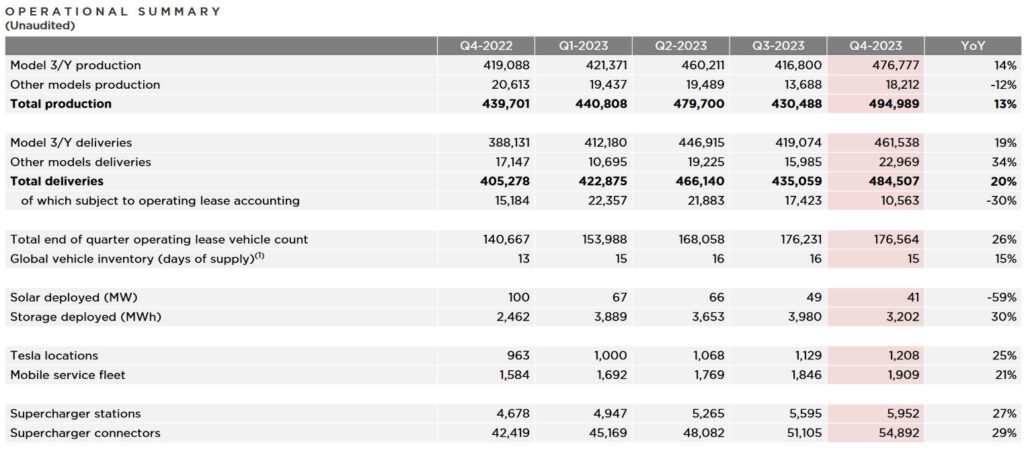

Tesla says that it delivered just 386,810 vehicles during the first quarter of 2024, which is 8.5 percent less than it did in Q1 2023. The last time it saw a year-over-year fall was in early 2020. That delivery figure is still far more than BYD’s delivery report of just 300,114 vehicles during the same Q1 2024 period. Here are the details about each result, what they mean for the EV sales crown, and what they could indicate for the rest of the year.

- Tesla delivered 386,810 vehicles in Q1 2024, 8.5% less than Q1 2023 and below analyst predictions.

- Both Tesla and BYD saw significant declines compared to Q4 2023, suggesting a potential slowdown in the EV market.

- Elon Musk suggests Tesla might be entering a period of slower growth, potentially lasting throughout 2024.

Analysts had predicted that Tesla would deliver roughly 455,000 vehicles, so falling short of that isn’t great. Compared to Q4 2023, Tesla saw a 20.2 percent decline in deliveries. Tesla stock was down nearly 6% in early trading following the release of the report but has since slightly recovered, being 3.5% down at the time of publishing, dropping from $175.12 on April 1st to $168.88. Nonetheless, it did manage to take back its delivery crown from BYD.

The Chinese automaker made waves when it became the leader in EV sales during Q4 2023. Now, it’s experienced a drop-off of 43 percent compared to Q4 2023. That indicates a decrease in demand across the market and the world. While BYD didn’t specify exactly why it saw a quarter-over-quarter nosedive, Tesla provided a few explanations for its own decline.

Specifically, it blamed the revamping of its Fremont factory for the updated Model 3, shipping diversions caused by the Red Sea conflict, and shutdowns at its Berlin plant. However, do these factors fully account for the surplus of some 47,000 vehicles that it couldn’t sell? Perhaps not. Elon Musk told investors in January that the automaker was “between two major growth waves.”

What this suggests is that there could be a slowdown for an extended period, perhaps even throughout the year, depending on various factors. The entire EV industry seems poised for a market correction. While legacy automakers like Ford, Chevrolet, and Stellantis can adjust by increasing ICE or hybrid production, Tesla doesn’t have that option. How it navigates the next 9-12 months will be crucial for achieving its short-term goals.

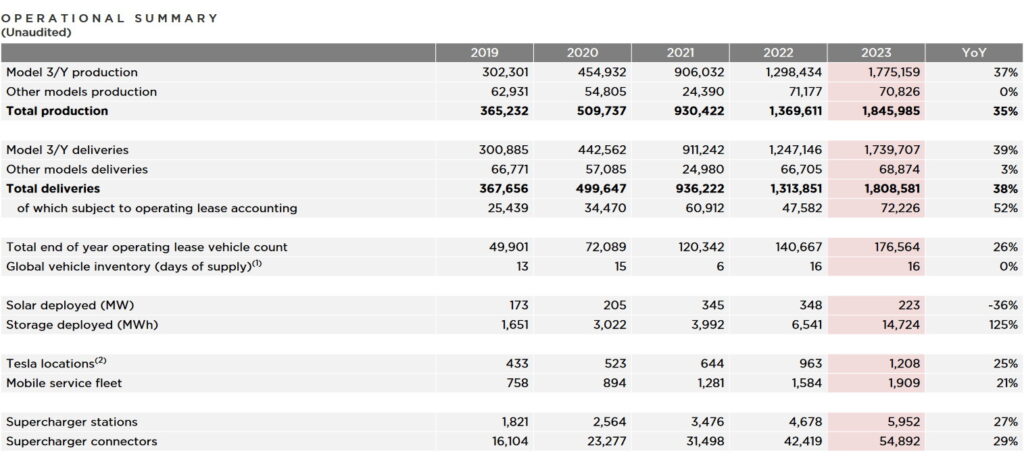

Quarterly Summary

Annual Summary

Tragic Bronson

Expert

- Messages

- 3,172

- Reactions

- 3,786

Is Elon Musk's Behavior Pushing Tesla Customers Away? | Carscoops

Musk's reputation once helped turn Tesla into a thriving automaker, now it may be holding it back

Tesla's Q1 Numbers Were Way Worse Than Expected - Jalopnik

There’s been a lot of talk about Tesla lately, but it has mostly been focused on the Cybertruck. The conversation hasn’t always been positive, but hey, at least people have been talking about Tesla. And all coverage is good for the company, right? Not necessarily. Tesla released its results for...

Last edited:

Tragic Bronson

Expert

- Messages

- 3,172

- Reactions

- 3,786

Tesla isn’t the victim of an EV sales slow-down, it’s a cause

Tesla’s stock price has dropped by nearly a third in 2024 as the company’s sales numbers and profits have disappointed. It’s been one of the worst performers in the S&P 500 so far this year.

Last year, Tesla sales were up 38% compared to 2022, but investors had expected more. Tesla warned in January that sales growth this year would be even slower.

As it turned out, sales haven’t grown at all in 2024. Instead, Tesla’s global first-quarter sales plunged more than 20% from the same time last year, marking the first time since the covid pandemic that sales have gone down over a year.

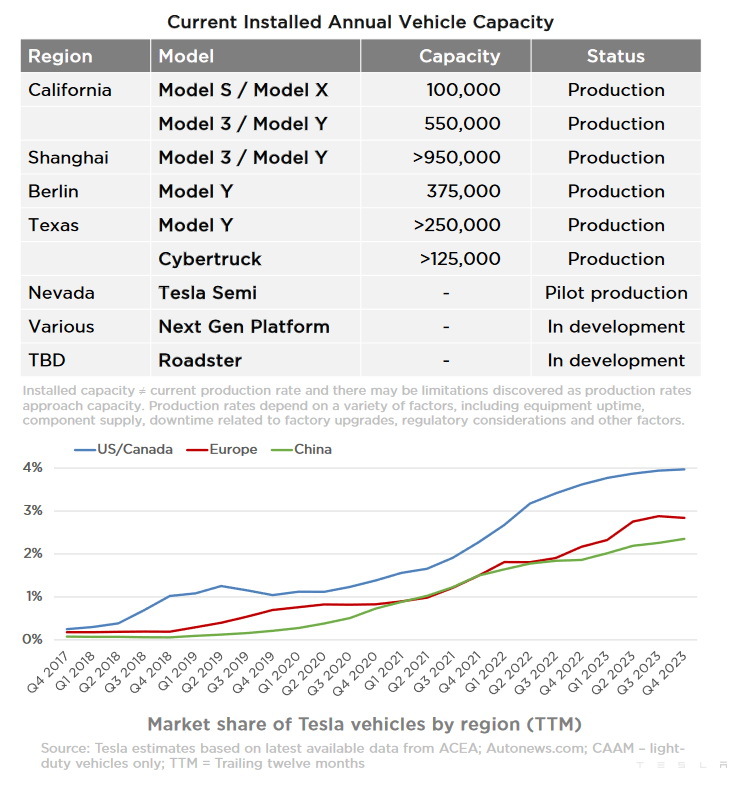

Tesla wasn’t just a victim of a general slow-down in EV interest, though. In the United States, Teslas still made up about 56% of all electric vehicles sold in 2023. While that’s much less than the roughly 80% of EV sales Tesla accounted for in 2019, according to Edmunds.com, it’s still a majority. When Americans lose interest in Teslas, it can look like an overall lack of interest in electric vehicles.

Between the first quarter of 2023 and the first quarter of 2024, US electric vehicle sales grew an estimated 15%, according to a recent report by Cox Automotive. But, if you leave out Tesla, sales of other electric vehicles, as a group, were up 33%.

The Tesla Model 3 and Model Y, its most popular models by far, are seven and five years old, respectively. Other automakers, like Ford, Audi, and Hyundai, offer competitive EV models that are much newer to the market.

“The two core Tesla products are excellent vehicles, but the auto industry revolves around ‘new’ models and fresher alternatives from competitors are likely slowing Tesla demand,” Valdez Streaty said in an email to CNN.

Tesla did not respond to a request for comment on the age of the company’s vehicle line-up.

The Tesla Cybertruck is new and garnering a lot of attention but it’s only just come out and, so far, is produced and sold in low numbers. Tesla is also rolling out an updated version of the Model 3 — although it remains, fundamentally, the same car.

Chinese automakers like BYD are also a major threat globally but they’re not even competing in the US market yet. Musk himself has called them “the most competitive car companies in the world.”

Will leave out the issues of Elmo himselfAs competing models hit the market that are similar in price, quality and performance to those Tesla offers, the public image baggage Musk adds to the brand could dissuade shoppers, Holm said.

“That’s something where the reputation a CEO imprints on a company’s brand and expression is carrying a lot of weight,” he said.

I beg to differ. I think the ev market is still nascent and its still working out nascent market issues.

Will leave out the issues of Elmo himself

-tesla is still the only mfg able to move units with a profit even with the oldest platform

-Everyone else is needs hugeeeeeeee subsidies (whether from the gov or mfgs) to show this 10000% yoy increases

-legacy is scaling back a lot of the ev product maps and shifting to hybrids.

-The demographic who has helped ev grow thus far already have their evs.

These include

1) Those who rely on primarily home charging,

2)first adopters

3)high income households

4) folks who live in ev friendly climates

5) multiple car households

6) Primarily city driving.

Product rd needs to address these issues, and whether its tesla or someone else will ultimately decide who runs the market.

Last edited:

Och

Admirer

- Messages

- 677

- Reactions

- 624

I beg to differ. I think the ev market is still nascent and its still working out nascent market issues.

-tesla is still the only mfg able to move units with a profit even with the oldest platform

-Everyone else is needs hugeeeeeeee subsidies to show this 10000% yoy increases

-legacy is scaling back a lot of the ev product maps and shifting to hybrids

-folks who rely on primarily home charging, first adopters, upper middle class, folks who live in ideal climates, multiple car households and those with with primarily city driving love evs. However the supply of these folks is finite, and drying up. Product rd needs to address these issues, and whether its tesla or someone else will win.

This pretty much nails it. I've always said EVs are only suitable as a secondary car for wealthy suburbanities, and they are what, 5% of the population in the US?

according to toyota, so take this with a massive truckload of doubt, 30% of marketshare ever.This pretty much nails it. I've always said EVs are only suitable as a secondary car for wealthy suburbanities, and they are what, 5% of the population in the US?

Tragic Bronson

Expert

- Messages

- 3,172

- Reactions

- 3,786

Anything but Tesla: US shoppers want more EV options

EV shoppers are growing tired of Tesla and want more options, a new study finds.

uh oh i guess no more 10x growth every 6 months.

Anything but Tesla: US shoppers want more EV options

EV shoppers are growing tired of Tesla and want more options, a new study finds.www.businessinsider.com

mikeavelli

Moderator

- Messages

- 7,512

- Reactions

- 16,686

Lmfao!!!!! The jokes write themselves

www.pcmag.com

www.pcmag.com

Tesla Owner Calls Police on Rivian Driver Using Supercharger

The encounter between a Rivian driver and uninformed Tesla owner highlights 'a need for better education and communication within the EV community,' the Rivian driver says.

- Status

- Not open for further replies.

-

This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register.

By continuing to use this site, you are consenting to our use of cookies.